JSC National Atomic Company “Kazatomprom” (“Kazatomprom”, “KAP” or “the Company”) announces the following operations and trading update for the second quarter and half-year ended 30 June 2022.

This update provides a summary of recent developments in the uranium industry, as well as provisional information related to the Company’s key second-quarter and half-year operating and trading results, and current 2022 guidance. The information contained in this Operations and Trading Update may be subject to change.

Market Overview

In a paper titled "Nuclear Power and Secure Energy Transitions," the International Energy Agency (IEA) examined how nuclear energy could aid in resolving the world’s ongoing energy security and climate crisis. The organization concurs that nuclear energy could play a significant role in helping nations securely transition to low-carbon energy generation. According to the IEA, countries that deploy or increase their use of nuclear energy reduce fossil fuels imports and carbon emissions, and they are able to integrate a larger share of renewable energy sources into their power networks. Based on the IEA’s analysis, strong regulations are required in order to boost the use of nuclear power, but the sector itself must also improve its ability to execute projects on time and within budget to ensure nuclear development plans can be relied upon for future electricity generation.

In South Korea, President Yoon Suk-Yeol announced the country’s most recent energy strategy, aimed at reducing the use of fossil fuels and undoing the previous administration's intentions to gradually reduce nuclear power capacity. According to the plan, nuclear energy would make up at least 30% of the country's energy mix in 2030, including the completion of unit 3 and unit 4 at the Shin Hanul nuclear power station, where progress was halted by previous President Moon Jae-in in 2017.

Subsequent to the second quarter on 06 July, the European Parliament formally included nuclear energy as a transitional green investment under the Sustainable Finance Taxonomy. As a result, the European Commission's proposal to classify investments in nuclear as being Taxonomy-compliant is anticipated to take effect 01 January 2023. Nuclear is included in the Taxonomy's "transitional" category, which means it is classified as an energy source that will help slow down climate change, but it cannot yet be replaced by technologically and economically feasible low-carbon alternatives.

A number of specific demand-side highlights emerged in the second quarter:

- In May, China General Nuclear’s Hongyanhe unit 6, a 1,061 MWe ACPR-1000 in Liaoning Province, China, successfully connected to the grid for the first time. China has now switched to building the more advanced HPR-1000 (Hualong One) reactor design; Hongyanhe unit 5 and unit 6 are therefore expected to be the final two reactors built in China based on the ACPR-1000 design.

- China National Nuclear Corporation (CNNC) and Russia’s Rosatom reported that on 19 May, the first concrete was poured to begin construction of Xudabao unit 4, a 1,200 MWe VVER-1200 PWR in Liaoning Province, China.

- In a similar development, CNNC’s subsidiary China National Nuclear Power announced that Sanmen Unit 3, a 1,163 MWe Chinese-designed CAP-1000 PWR, formally began construction with the first pouring of nuclear safety-related concrete on 28 June. The Sanmen Nuclear Station is located in Zhejiang Province and currently hosts two operating Westinghouse AP1000 PWRs, unit 1 and unit 2 at 1,157 MWe each.

- In June, Korea Hydro & Nuclear Power reported that Shin Hanul unit 1, a 1,400 MWe APR-1400 PWR, successfully completed grid connection in South Korea.

- In the US, Entergy’s single-unit Palisades Nuclear facility in Michigan, USA, was permanently shut down in May after more than 50 years of safe operation. The decision to shut the 805 MWe PWR was made in 2017 as part of Entergy’s plan to exit the merchant nuclear power business.

In a notable supply-side highlight, Boss Energy Ltd. (“Boss”) announced that its board of directors approved development of the Honeymoon in-situ recovery project in South Australia. The company indicated the project has an estimated cost of A$113 million, which would be funded by its previous capital raising activity in March 2022, when Boss raised A$125 million. The company expects Honeymoon to resume production in late 2023 and ramp up to steady-state production of 2.45 million pounds U3O8 per year within three years.

The nuclear fuel processing cycle requires that various forms of uranium be transported all over the world. Transportation challenges were highlighted throughout the first half of 2022 due to many nations’ and companies’ efforts to reduce transactions with and decrease reliance on Russia, in light of Russia’s actions in Ukraine. Most recently, Canada's revision to its Special Economic Measures on Russia resulted in shipping delays for a Russian enriched uranium product (EUP) delivery that was destined for the United States. As per third-party sources, the modified Canadian rules could be interpreted to mean the Canadian company CIS Navigation and it’s carrier, Atlantic Ro-Ro Carriers (CISN/ARRC), would be unable to transport Russian EUP from the port of St. Petersburg to three American utilities aboard its Canadian-owned vessel. However, industry-sources have indicated that the Canadian government granted CISN/ARRC a temporary one-year exemption in order to continue shipments of Russian EUP. Western deliveries of Kazakh U3O8 were not impacted by the modified Canadian rules.

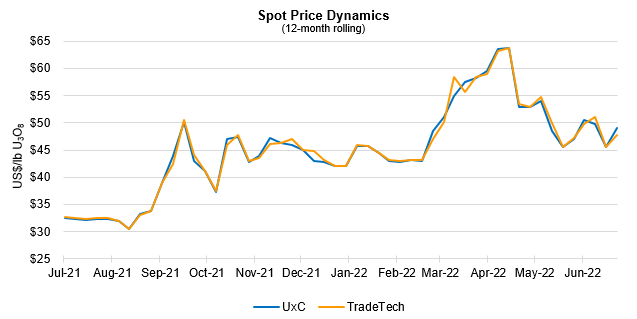

Market Pricing and Activity

At the outset of the second quarter, market participants were primarily concerned about security of supply in light of the Russia-Ukraine conflict, which drove the weekly spot price up to US$63.75/lb U3O8, its highest level since March 2011. However, a lack of firm contracting activity in the spot market coupled with the impact of a bearish equity market and global economic slow-down exerted downward pressure on the spot price throughout the weeks and months that followed. In June, spot remained volatile and month-end concerns about a potentially delayed Russian EUP delivery from St. Petersburg pushed the average spot price back up to US$50.00/lb U3O8 by the end of the quarter.

According to third-party market data, intermediaries were responsible for most of the spot market activity through the first half of 2022, with volumes similar to the same period last year. A total of 32.6 million pounds U3O8 (~12,500 tU) was transacted at an average weekly spot price of US$50.30/lb U3O8 year-to-date in 2022, compared to about 35.6 million pounds U3O8 (~13,700 tU) at an average weekly spot price of US$29.95/lb U3O8 in the first six months of 2021.

In the term market, contracting activity was substantially higher than in the previous year, with third-party data indicating that contracted volumes totaled about 71.5 million pounds U3O8 (~27,500 tU) through the first six months of 2022, compared to about 37.5 million pounds U3O8 (~14,400 tU) in the same period of 2021. The increase in term market activity resulted in an increase of the average long-term price by US$17.50/lb U3O8 year-over-year, to US$49.75/lb U3O8 at the end of the second quarter of 2022 (reported only on a monthly basis by third-party sources).

Company Developments

Transportation risk mitigation

A significant proportion of the Company’s products are exported on a well-established primary route through Russia to the Port of St. Petersburg, which presents a specific set of risks associated with transit through the territory of Russia, shipping insurance, and the delivery of cargo by sea vessels. Kazatomprom continues to monitor the growing list of sanctions on Russia and the potential impact they could have on the transportation of products through Russian territory. To date, there are no issues or restrictions on the Company's activities related to the supply of its products to customers worldwide. Kazatomprom shipped its second quarter volumes via St. Petersburg without any disruptions or logistical/insurance-related issues.

The Company’s Trans-Caspian route, which has been successfully used as an alternative route since 2018, helps to mitigate the risk of the primary route being unavailable, for any reason. In the current environment of geopolitical uncertainty, Kazatomprom has sought to reinforce a number of transit agreements with the pertinent authorities along the Trans-Caspian route; the Company has received approval to ship 3,500 tons of uranium and has applied for an increase in order to accommodate potential total shipments by Kazatomprom and its joint venture partners in excess of that quota.

The Company continues to assist JV partners in their efforts to ship material through the Trans-Caspian route. Whether shipped by Kazatomprom or its partners sharing Kazakh assets, the product remains of Kazakh origin through to its arrival at a western conversion facility.

In addition to physical deliveries, the Company maintains inventories at a number of global locations and it has the ability to negotiate swaps with partners and customers to help mitigate potential risks to Kazatomprom’s deliveries.

Information on dividend payments

The payment of dividends for 2021 to shareholders of record as at 14 July 2022 (00:00 local time (GMT+6)) began 15 July 2022 and was completed on 19 July 2022. A total of KZT 227,388,312,497.92 (two hundred twenty-seven billion three hundred eighty-eight million three hundred twelve thousand four hundred ninety seven tenge 92 tiyn) or KZT 876.74 per one ordinary share (one GDR is equal to one ordinary share), was paid to the Company's shareholders, according to the decision adopted by the Annual General Meeting of Shareholders (minutes No. 1 of 27 May 2022).

Kazatomprom’s Management Board

As previously disclosed, Mr. Mazhit Sharipov departed from his roles as the Company’s Chief Executive Officer (CEO) and Chair of the Management Board, and resigned from Kazatomprom’s Board of Directors, for personal reasons, effective 04 July 2022. Kazatomprom’s Chief Operating Officer, Mr. Yerzhan Mukanov, was appointed as acting CEO while the Company’s Board of Directors completes a recruitment process to assess appropriate candidates for the CEO position.

Full biographies for all members of the Executive Board are available on the Company’s website, www.kazatomprom.kz.

Competent Person’s Report

Kazatomprom has published a fully updated Competent Person’s Report (“CPR”), prepared by SRK Consulting (UK) Limited in accordance with the terms and definitions of the Joint Ore Reserves Committee (JORC) Code. The CPR provides updated economic and operating details for the Company’s uranium mining and exploration assets located in the Republic of Kazakhstan as at 31 December 2021. The Company’s previous CPR was published as part of the IPO Prospectus in 2018; the updated CPR is now available in the Investors section of the Company’s website in English only (Russian translation will be published when available), https://www.kazatomprom.kz.

Kazatomprom’s 2022 Second-Quarter and Half-Year Operational Results1

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

||

|

(tU as U3O8 unless noted) |

2022 |

2021 |

Change |

2022 |

2021 |

Change |

|

U3O8 Production volume (100% basis)2 |

5,116 |

5,526 |

(7%) |

10,070 |

10,451 |

(4%) |

|

U3O8 Production volume (attributable basis)3 |

2,729 |

3,073 |

(11%) |

5,414 |

5,864 |

(8%) |

|

Group U3O8 sales volume4 |

6,421 |

4,915 |

31% |

9,017 |

6,193 |

46% |

|

KAP U3O8 sales volume (incl. in Group)5 |

5,677 |

3,901 |

46% |

8,032 |

5,179 |

55% |

|

Group average realized price (USD/lb U3O8)6* |

41.90 |

29.39 |

43% |

40.88 |

29.63 |

38% |

|

KAP average realized price (USD/lb U3O8)7* |

40.91 |

29.41 |

39% |

39.70 |

29.63 |

34% |

|

Average month-end spot price (USD/lb U3O8)8* |

50.17 |

30.85 |

63% |

50.09 |

30.18 |

66% |

1 All values are preliminary.

2 U3O8 Production volume (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it therefore disregards the fact that some portion of that production may be attributable to the Group’s joint venture partners or other third party shareholders. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

3 U3O8 Production volume (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, which corresponds only to the size of such interest; it therefore excludes the remaining portion attributable to the JV partners or other third party shareholders, except for production from JV “Inkai” LLP, where the annual share of production is determined as per the Implementation Agreement disclosed in the IPO Prospectus. Actual drummed production volumes remain subject to converter adjustments and adjustments for in-process material.

4 Group U3O8 sales volume: includes the sales of U3O8 by Kazatomprom and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group’s returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity). For consistency, Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to the sales of fuel pellets).

5 KAP U3O8 sales volume (incl. in Group): includes only the total external sales of U3O8 of KAP HQ and Trade House KazakAtom AG (THK). Intercompany transactions between KAP HQ and THK are not included.

6 Group average realized price (USD/lb U3O8): average includes Kazatomprom’s sales and those of its consolidated subsidiaries, as defined in parenthesis in footnote 4 above.

7 KAP average realized price (USD/lb U3O8): the weighted average price per pound for the total external sales of KAP HQ and THK. The pricing of intercompany transactions between KAP HQ and THK are not included.

8 Source: UxC LLC, TradeTech. Values provided are the average of the month-end uranium spot prices quoted by UxC and TradeTech, and not the average of each weekly quoted spot price throughout the month. Contract price terms generally refer to a month-end price.

* Note the conversion of kgU to pounds U3O8 is 2.5998.

Production on a 100% basis was lower in the second quarter and first half of 2022 compared to the same periods in 2021, due to the impact of the COVID-19 pandemic on wellfield development in 2021. There is typically an eight- to ten-month lag between wellfield development and uranium extraction by in-situ recovery, therefore in 2021, delays and/or limited access to certain key materials and equipment affected the wellfield commissioning schedule at the time, resulting in lower production a half-year later in 2022. Production on an attributable basis in the second quarter and first half of 2022 was lower compared to the same period in 2021 primarily due to the sale of a 49% share of “Ortalyk” LLP to CGN Mining UK Limited in July 2021.

In the second quarter and first half of 2022, both Group and KAP sales volumes were significantly higher compared to the same periods in 2021, primarily due to the timing of customer-scheduled deliveries. Sales volumes can vary substantially each quarter, and quarterly sales volumes vary year to year due to variable timing of customer delivery requests during the year, and physical delivery activity.

Average realized prices for both the second quarter and first half of 2022 were higher compared to the same periods in 2021 due to a higher uranium spot price. The Company’s current overall contract portfolio pricing correlates closely to uranium spot prices. However, for short-term deliveries to end-user utilities, the spot price can vary significantly between the time contract pricing is established according to Kazakh transfer pricing regulations, and the spot price in the general market when the actual delivery takes place. The market volatility during that time lag between price-setting and delivery becomes more evident as volatility increases, in both rising and falling price conditions. In addition, some long-term contracts incorporate a proportion of fixed pricing that was negotiated prior to the sharp increase in spot price. As a result, increases in both the Group and KAP’s average realized prices in the first half of 2022 compared to the same period in 2021 were lower than the increase in the spot market price for uranium over the same intervals.

In the uranium market, the trends in quarterly metrics and interim results are rarely representative of annual expectations; for annual expectations, please see the Company’s guidance metrics below, as well as its price sensitivity table from section 12.1 Uranium sales price sensitivity analysis, in the Company’s Operating and Financial Review for 2021.

Kazatomprom’s 2022 Reiterated Guidance

|

(exchange rate 460 KZT/1USD) |

2022 |

|

Production volume U3O8 (tU) (100% basis)1 |

21,000 – 22,0002 |

|

Production volume U3O8 (tU) (attributable basis)3 |

10,900 – 11,5002 |

|

Group U3O8 sales volume (tU) (consolidated)4 |

16,300 – 16,800 |

|

Incl. KAP U3O8 sales volume (incl. in Group) (tU)5 |

13,400 – 13,900 |

|

Revenue - consolidated (KZT billions)6 |

930 – 950 |

|

Revenue from Group U3O8 sales, (KZT billions)6 |

790 – 810 |

|

C1 cash cost (attributable basis) (USD/lb)* |

$9.50 – $11.00 |

|

All-in sustaining cash cost (attributable C1 + capital cost) (USD/lb)* |

$16.00 – $17.50 |

|

Total capital expenditures of mining entities (KZT billions) (100% basis)7 |

160-170 |

1 Production volume U3O8 (tU) (100% basis): Amounts represent the entirety of production of an entity in which the Company has an interest; it disregards that some portion of production may be attributable to the Group’s JV partners or other third-party shareholders.

2 The duration and full impact of the COVID-19 pandemic and the Russian-Ukrainian conflict is not yet known. Annual production volumes could therefore vary from internal expectations.

3 Production volume U3O8 (tU) (attributable basis): Amounts represent the portion of production of an entity in which the Company has an interest, corresponding only to the size of such interest; it excludes the portion attributable to the JV partners or other third-party shareholders, except for JV “Inkai” LLP, where the annual share of production is determined as per Implementation Agreement as disclosed in IPO Prospectus.

4 Group sales volume: includes the sales of U3O8 by Kazatomprom’s sales and those of its consolidated subsidiaries (companies that KAP controls by having (i) the power to direct their relevant activities that significantly affect their returns, (ii) exposure, or rights, to variable returns from its involvement with these entities, and (iii) the ability to use its power over these entities to affect the amount of the Group’s returns. The existence and effect of substantive rights, including substantive potential voting rights, are considered when assessing whether KAP has power to control another entity). For consistency, Group U3O8 sales volumes do not include other forms of uranium products (including, but not limited to the sales of fuel pellets).

5 KAP sales volume: includes only the total external sales of U3O8 of KAP HQ and THK. Intercompany transactions between KAP HQ and THK are not included.

6 Revenue estimates have only been updated to account for a change in expectations for uranium price and exchange rate for the Kazakhstani Tenge. Revenue expectations are based on a uranium prices taken at a single point in time from third-party sources and on an internal exchange rate assumption of KZT460:USD1. There continues to be significant volatility in both uranium price and the tenge exchange rate. Therefore, 2022 revenue could be materially impacted by how actual uranium prices and exchange rates vary from the third-party and internal estimates respectively.

7 Total capital expenditures (100% basis): includes only capital expenditures of the mining entities, excluding expansion investments.

* Note that the conversion of kgU to pounds U3O8 is 2.5998.

All 2022 guidance metrics remain unchanged from previous expectations at this time. However, Total capital expenditures of mining entities are trending below budgeted levels at the half-year and remain under review for Kazatomprom’s upcoming Operating and Financial Review for six-months ended 30 June 2022, expected to be disclosed 19 August 2022.

COVID-19 disrupted the overall production supply chain in 2021, resulting in a shortage of certain production materials, such as reagents and piping, which led to a shift in the commissioning schedule for new wellfields. Because of the shift, uranium production volumes through the first half of 2022 fell short of internal expectations. In addition to the delays in the commissioning schedule for new well fields, shortages of certain materials, including sulfuric acid, also have a negative impact on development and production activities. Despite these challenges, the Group is maintaining its 2022 production plan and making every effort to achieve it, though final year-end volumes could fall short if wellfield development and supply chain issues continue throughout the second-half of the year.

Revenue, C1 cash cost (attributable basis) and All-in Sustaining cash cost (attributable C1 + capital cost) may vary from the ranges shown, to the extent that the KZT-to-USD exchange rate and uranium spot price differ significantly from the Company’s assumptions.

The Company only intends to update annual guidance in relation to operational factors and internal changes that are within its control. Key assumptions used for external metrics, such as exchange rates and uranium prices, are established using third-party sources during the Company’s annual budget process in the previous year; such assumptions will only be updated on an interim basis in exceptional circumstances.

The Company continues to target an inventory level of approximately six to seven months of annual attributable production. However, inventory could fall below these levels due to Pandemic-related production losses. As such, during the second quarter, several transactions to purchase material in the spot market were carried out and the Company will continue to monitor market conditions for opportunities to optimize its inventory levels.

Changes to the Tax code of Kazakhstan

In January 2022, the government of the Republic of Kazakhstan announced that it intended to update the country’s tax code. Under the current code, the base value for the Mineral Extraction Tax (“MET”), as applied to uranium extraction, is determined by increasing actual production costs (mining and primary processing costs in accordance with international financial reporting standards) by 20% and to that value, applying a tax rate of 18.5%, resulting in a 29% tax charge to the taxable base related to mining production costs.

On 11 July 2022, additions and amendments to the Kazakh tax code were adopted (Laws of the Republic of Kazakhstan “On the Enactment of the Code of the Republic of Kazakhstan “On Taxes and Other Mandatory Payments to the Budget” No. 135-VII LRK), which will change the calculation of the MET base and rate for uranium extraction in 2023. In accordance with the introduced changes, the tax base for MET on uranium will be determined as the weighted average price of uranium from public price reporting sources for the specific reporting period, multiplied by the amount of uranium mined and a MET rate of 6%. The new tax code comes into force beginning 01 January 2023 and it does not impact 2022 guidance or the Company’s expectations related to taxation in 2022. More detailed information on MET changes will be included in the upcoming Operating and Financial Review for six months ended 30 June 2022, expected to be disclosed 19 August 2022.

Conference Call Notification - 2022 Half-Year Operating and Financial Review (19 August 2022)

Kazatomprom has scheduled a conference call to discuss the 2022 half-year operating and financial results, after they are released on Friday, 19 August 2022. The call will begin at 17:00 (AST) / 11:00 (GMT) / 07:00 (EDT). Following management remarks, an interactive English Q&A session will be held with investors.

For the English live webcast (participants on the webcast can also submit questions during the event), conference call dial-in details and for information on how to participate in the Q&A, please visit:

For the Russian live webcast (listen-only, no Q&A) and corresponding dial-in details, please visit:

A recording of the webcast will also be available at www.kazatomprom.kz shortly after it concludes.

For further information, please contact:

Kazatomprom Investor Relations Inquiries

Cory Kos, International Adviser, Investor Relations

Botagoz Muldagaliyeva, Director of Investor Relations

Tel: +7 (8) 7172 45 81 80

Email: ir![]() kazatomprom.kz

kazatomprom.kz

Kazatomprom Public Relations and Media Inquiries

Gazhaiyp Kumisbek, Chief Expert of GR & PR Department

Tel: +7 (8) 7172 45 80 63

Email: pr![]() kazatomprom.kz

kazatomprom.kz

About Kazatomprom

Kazatomprom is the world's largest producer of uranium, with the Company’s attributable production representing approximately 24% of global primary uranium production in 2021. The Group benefits from the largest reserve base in the industry and operates, through its subsidiaries, JVs and Associates, 26 deposits grouped into 14 mining assets. All of the Company’s mining operations are located in Kazakhstan and extract uranium using ISR technology with a focus on maintaining industry-leading health, safety and environmental standards (ISO 45001 and ISO 14001 compliant).

Kazatomprom securities are listed on the London Stock Exchange, Astana International Exchange, and Kazakhstan Stock Exchange. As the national atomic company in the Republic of Kazakhstan, the Group's primary customers are operators of nuclear generation capacity, and the principal export markets for the Group's products are China, South and Eastern Asia, Europe and North America. The Group sells uranium and uranium products under long-term contracts, short-term contracts, as well as in the spot market, directly from its headquarters in Nur-Sultan, Kazakhstan, and through its Switzerland-based trading subsidiary, Trade House KazakAtom AG (THK).

For more information, please see the Company website at www.kazatomprom.kz

Forward-looking statements

All statements other than statements of historical fact included in this communication or document are forward-looking statements. Forward-looking statements give the Company’s current expectations and projections relating to its financial condition, results of operations, plans, objectives, future performance and business. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target,” “believe,” “expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,” “project,” “will,” “can have,” “likely,” “should,” “would,” “could” and other words and terms of similar meaning or the negative thereof. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond the Company’s control that could cause the Company’s actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which it will operate in the future. THE INFORMATION WITH RESPECT TO ANY PROJECTIONS PRESENTED HEREIN IS BASED ON A NUMBER OF ASSUMPTIONS ABOUT FUTURE EVENTS AND IS SUBJECT TO SIGNIFICANT ECONOMIC AND COMPETITIVE UNCERTAINTY AND OTHER CONTINGENCIES, NONE OF WHICH CAN BE PREDICTED WITH ANY CERTAINTY AND SOME OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY. THERE CAN BE NO ASSURANCES THAT THE PROJECTIONS WILL BE REALISED, AND ACTUAL RESULTS MAY BE HIGHER OR LOWER THAN THOSE INDICATED. NONE OF THE COMPANY NOR ITS SHAREHOLDERS, DIRECTORS, OFFICERS, EMPLOYEES, ADVISORS OR AFFILIATES, OR ANY REPRESENTATIVES OR AFFILIATES OF THE FOREGOING, ASSUMES RESPONSIBILITY FOR THE ACCURACY OF THE PROJECTIONS PRESENTED HEREIN. The information contained in this communication or document, including but not limited to forward-looking statements, applies only as of the date hereof and is not intended to give any assurances as to future results. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to such information, including any financial data or forward-looking statements, and will not publicly release any revisions it may make to the Information that may result from any change in the Company’s expectations, any change in events, conditions or circumstances on which these forward-looking statements are based, or other events or circumstances arising after the date hereof.